We would argue that the benefits of having a town council are not primarily about costs but about providing meaningful local democracy, empowering a representative body to campaign for the town, and foster community life.

Not surprisingly though, there has been discussion of the cost implications of establishing a town council and it seems useful to provide some more information on the issue here.

Precepts and special expenses

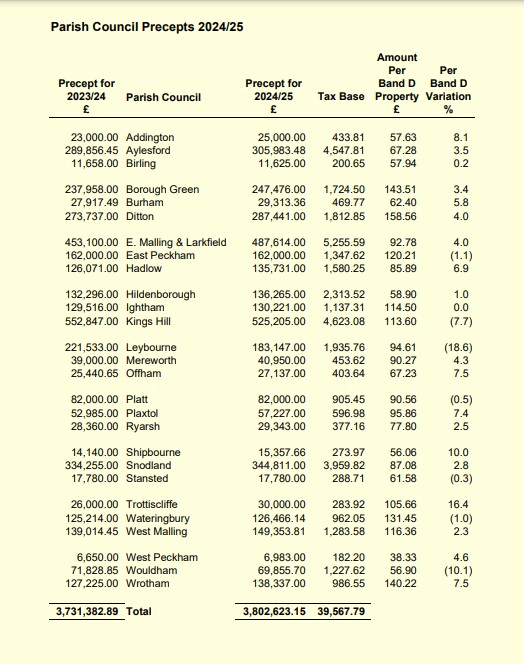

Town and parish councils do need funding (these budgets cover the costs of services the council provides and the expense of running the council. Major services such as roads, planning, social services, education and rubbish collection are run by the Borough or County Councils, so town and parish council budgets are relatively modest typically forming 5-10% of the total council tax bill – for example Hildenborough Parish Council has an annual budget of £140,000 whilst Sevenoaks Town Council has a budget of £2million. These costs are paid for as a precept via the council tax bill. The prime services provided at this level are running of open spaces, parks, play areas, sports grounds, public toilets, local events and community activities.

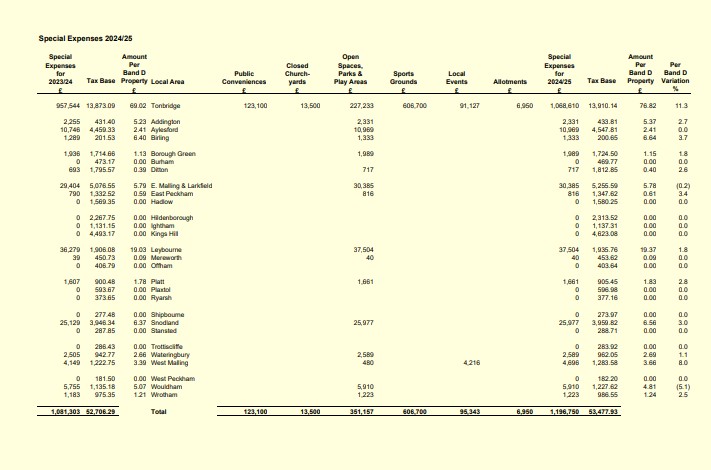

In Tonbridge there is no town council so there is no precept, instead these services are provided directly by TMBC and are paid for via “special expenses” which is directly equivalent to a parish precept. Currently the special expenses charge is £78 per Band D property. The table provides details of the special expenses over the last few years (source – datafiles on the TMBC website).

Which services might a town council take over from TMBC, and what would be the cost implication?

In principle all the services currently funded from special expenses could be taken over by the town council, however, the indication from TMBC have been that it would expect to/argue for maintaining ownership and management of the sports grounds and open spaces. We would expect that the remaining items – local events, allotments, closed churchyards and public conveniences would be taken over by the town council. For any of these the budget would transfer along with the responsibility, so the special expense charge would decrease, and the town council precept increase with no net effect on the council tax bill. We believe it would be particularly valuable for the town council to take on the local events funding role , to properly support community initiatives such as the Tonbridge Calling music event and to develop events comparable to the Tunbridge Wells Art Festival or Hastings Fat Tuesday.

How much would running a minimal town council cost?

The cost of running a town council would depend on how much it did. For a minimal town council running only limited services such as churchyards, allotments and toilets then running costs similar to a parish council would be likely – typically employing a town clerk, paying for meeting space and office costs for the clerk. For that a budget of ca £100,000-150,000 would seem reasonable. A charge of £10 on the precept would raise £140,000. So, we estimate the basic additional cost to council tax payers of having a town council in Tonbridge would £10/year.

How much might a more ambitious town council end up costing us?

Obviously an ambitious and pro-active town council might take on extra responsibilities. For example, in Sevenoaks the town council runs the Stag Theatre, community centres, a youth club, the no 8 local bus service, street markets, and a community grant scheme. This is a level of community activity we would welcome but obviously it would require a larger council staff and cost money. The precept in Sevenoaks is £150/year for a band D property. Increasing to that sort of level in the short term (1-5 years) is very unlikely and would be subject to democratic control, but it is certainly possible that in the medium to long term (5-20 years) the town would choose to make this sort of level of investment in the community.

Is the precept capped?

Town and parish precepts are not capped, unlike the rest of council tax. By contrast whilst the special expenses we currently pay are not directly capped they do count toward the “core expenses” of TMBC , which are capped. So changing to a town council would remove some constraint on council tax bills although since the precept is a small part of the total council tax bill even a doubling of the charge which could provide the level of community investment seen in Sevenoaks, would only result in a 5% increase in council tax bills.

Is investing in a town council worthwhile?

Independent research (Aberystwyth University, 2003) found that the benefits of town and community councils far outweigh the costs. Here’s why Tonbridge deserves one:

Local Representation: Currently, Tonbridge residents have one borough councillor for every 2,320 people, whereas in areas with town councils, there is one town councillor for every 250 people. A town council ensures better representation.

Greater Local Control: A town council focuses solely on Tonbridge, rather than balancing priorities across the entire borough. This means better decision-making for local services, events, and infrastructure.

Community Investment: Town councils can apply for grants and funding that Tonbridge currently misses out on. They also reinvest directly in the local area, funding community projects, sports clubs, and events.

Transparency & Accountability: Town councils must hold public meetings and publish audited accounts, meaning residents have a greater say in how money is spent. Currently, decisions about Tonbridge are made behind closed doors by a borough council that prioritises parished areas.

Preserving & Enhancing Local Services: A town council could prevent further service cuts, protect community assets, and provide additional amenities like better town centre maintenance, local events, and support for the businesses, sports clubs, schools, and voluntary groups which make up our community.

Special Expenses for Tonbridge

NB – For more details on what’s covered there is a nice leaflet produced by TMBC in 2019/20 available here.

There are legitimate questions about how much a town council will cost and currently the only indication we have of the possible costs relate to the cost of services delivered elsewhere by parish councils but provided in Tonbridge by TMBC. These are currently paid for through the charge known as Special Expenses.

For information we have been sharing the latest tables of these costs at the various meetings and events to illustrate costs incurred elsewhere.

In the case of a Tonbridge Town Council there will be additional costs to pay for a Clerk and the costs of holding meetings. These costs will be shared between the 13,910 households who receive council tax bills in Tonbridge.